Capital Markets

Delton Chen’s carbon coin: from sci-fi to reality

A hydrogeologist had a theory about monetary policy to fund carbon capture. Now he’s making it happen.

Published

3 years agoon

By

admin

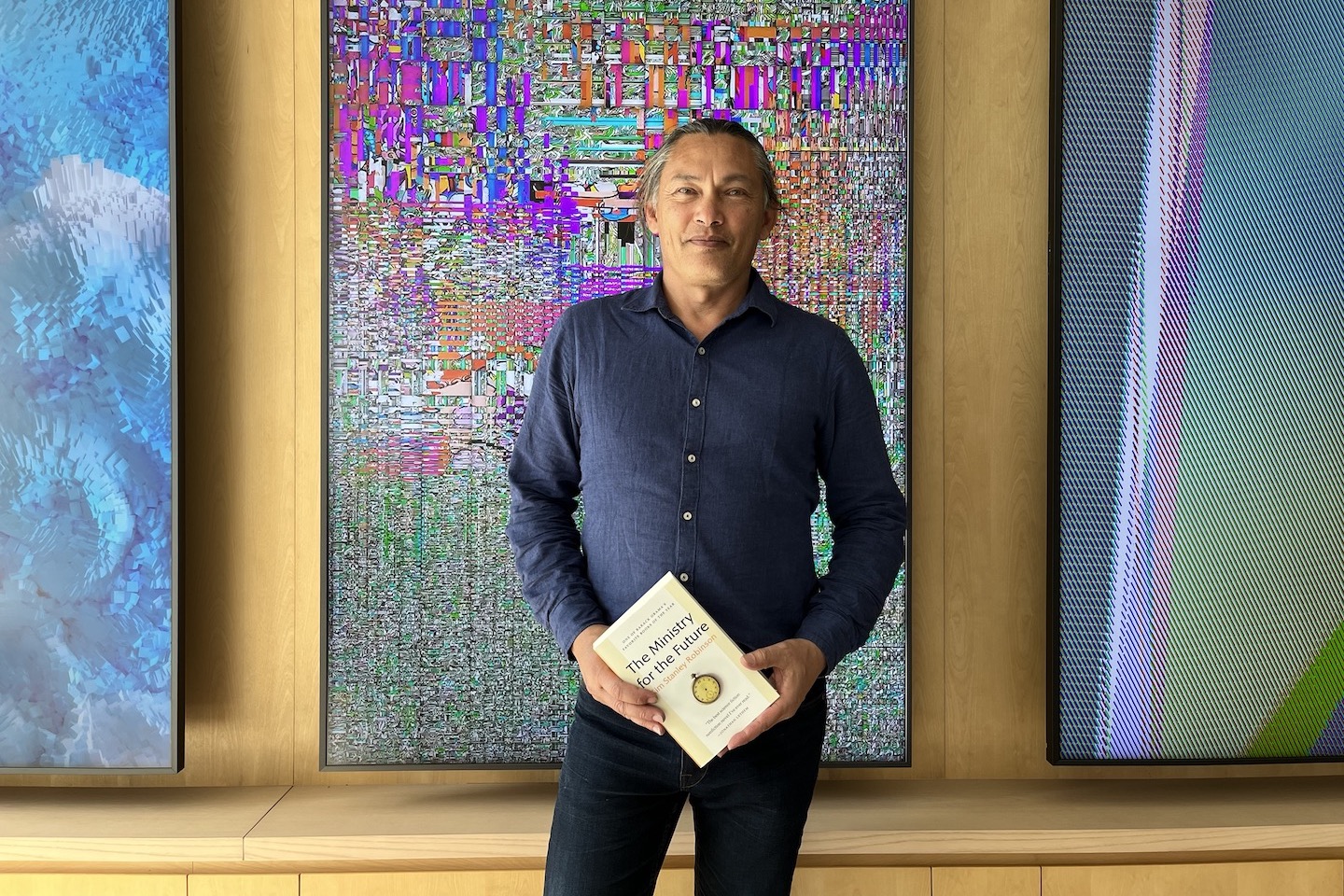

Delton Chen’s flight from San Francisco was two hours late into Hong Kong, so he apologized for a minor delay to his meeting with DigFin – his first stop in town. But anyone ready for an interview straight out of Chep Lap Kok has nothing to apologize for, and the next ninety minutes of discussion more than made up for an extra five waiting in his hotel lobby.

Chen is not famous but that might change. He barely registers on social media. But he’s on a mission to become a familiar presence in the halls of central banks – and to maybe save the world.

He has proposed the idea of a carbon coin, backed by the world’s central banks, to pay companies for removing carbon from the atmosphere. He published it with two co-authors in 2018 in a dense academic paper titled “Carbon Quantitative Easing”.

The coin would be issued as a central-bank digital currency, managed by a central authority under the United Nations. It would be part of a broader framework of carrots and sticks to effect rapid decarbonization, along with a global carbon tax, subsidies for carbon mitigation, and a cap-and-trade market for carbon offsets. The global carbon reward is the fourth element to incentivize the hardest changes that would defy private solutions and are too expensive to rely on funding by taxpayers.

Ministry of the Future

Kim Stanley Robinson, the American science-fiction novelist, came across it and made Chen’s idea the centerpiece of his 2021 bestseller, The Ministry of the Future.

Robinson’s version spent a lot of time extolling blockchain, a vision the author has since repudiated, having decided that cryptocurrencies are scams. But Chen, noting that the carbon reward is meant to represent fiat money in digital form rather than private crypto, is leveraging the book’s success to turn his hypothesis for carbon currency into an action plan.

Delton Chen is a trained civil engineer and hydrogeologist. His career in his native Australia had for many years involved environmental impact assessments for mining companies. In 2007 he decided to focus on work related to climate, but grew frustrated as a geothermal project collapsed.

“I could see the world lacks finance for climate,” he says. “There’s no policy source of funds that can scale to meet the need. That’s the problem.”

The amounts required to meet the Paris Agreement are high. That accord, signed in 2015, requires countries reach net zero emissions mid-century and hold the temperature rise by 2100 to below 2 degrees centigrade, which scientists reckon is the upper limit of planetary warming that society can survive.

In the most optimistic scenarios, we need to both cut emissions (through transitioning to renewable energy sources, and so on) and remove carbon that’s already in the atmosphere. We need to capture on average 10 gigatons of carbon every year for 100 years, which today works out to a cost of $1 trillion per annum.

The world has not come up with a formula about who will pay for this.

The value of money

Chen began to think about, if it’s money that’s required, well, what is money, anyway?

What infuses money or a commodity with value? Why did societies once rely on gold and silver, and then embrace money created by government fiat?

“My own answer is that money is non-intrinsic,” he says. “People say gold has some intrinsic value, but it really doesn’t. Its value depends on social context” in which money can fulfill functions such as facilitating payments, serving as a store of value, and acting as a unit of account.

Change the context, and a new currency could work. This sounds like the reasoning behind Bitcoin, which DigFin thinks has failed in its original purpose of serving as a payments token (and is an environmental disaster).

- Read more:

- Digital exchange wins final license for carbon “ADRs”

- Hedge fund launches ESG strategy for crypto

- What does interoperability mean for CBDCs?

But there is a fundamental difference. Bitcoin and other cryptocurrencies exist only in an imaginary social context. People believe the price of a coin will go up because someone else also believes it, which leads to cycles of greater fools speculating on worthless cryptographic hashes.

DigFin might augment Chen’s observation of money by noting that all money originates as a public-private tool to pay one’s debts – with those debts ultimately sourced to government debt. Public and private debt is the social context in which money exists. (Which is why Bitcoin isn’t money.)

Action versus education

Chen’s idea is that a carbon coin must be issued and managed by big governments. Central banks can change the social context by minting a currency as a reward for capturing carbon out of the sky or paying for rapid decarbonization in industry.

He began to think how it might work in 2013, amid the wreckage of his geothermal project. He heard Al Gore give his talk at a conference in Istanbul. The documentary An Inconvenient Truth, about Gore’s campaign as vice president to educate people about global warming, came out in 2006, and the former U.S. vice president hadn’t stopped banging the drum.

But Chen wasn’t inspired. He was annoyed. He was an engineer who had dedicated his work to the problem. “I thought communicating about climate change was silly. We need solutions, not going into schools and telling kids how depressing the world is going to be.”

Gore’s message did resonate, of course – certainly with DigFin. And maybe with Chen, too, because he realized he needed a narrative. Gore was good at telling a story, but his solution was lame: for people to make everyday choices to reduce their own carbon footprint. But climate change is too complex for simple campaign slogans: it needs to be approached through systems thinking.

The failure of current policy

There is no way that individual choices will make a dent in global emissions, not when our economy has been designed over two centuries around burning fossil fuels. Nor do they even begin to approach the $1 trillion annual cost of carbon capture and the additional $3 trillion per annum required for energy transition. Besides this, people will resist paying higher taxes; companies will oppose policies that hurt their business.

There is another problem with the current approach. Developed countries have pledged to help emerging markets finance their carbon transition needs, via the Green Climate Fund established by the United Nations in 2010, run by the World Bank. The rich world pledged to donate $100 billion by 2020, but only $8 billion had been allocated, and most of that is in the form of loans.

“If we can’t raise $100 billion, how are we going to raise $1 trillion?” Chen wonders.

And: this fails if it’s in the form of loans. Carbon capture is an activity that also requires energy, but the end result is a lump of carbonized rock with no commercial value. How are countries supposed to pay back loans with interest from this?

“No one has a product for captured carbon, except maybe Coca-Cola to make fizzy drinks,” Chen says. “This is a cost, so debt won’t work. It has to be grants. But there’s no policy.”

An early thought experiment

Chen imagined how a carbon currency might be the key to triggering the required change. Say there’s an island facing deforestation. Some people want to keep cutting down trees because it provides energy; others fight to save the trees or plant new ones.

In Chen’s story, the government introduces a second currency. There is a fiat currency, and a representative currency that “represents” the reward for safeguarding or planting trees. Over time the RepCoin is accepted as money in the wider economy, and the government manages its gradual appreciation, presumably through a currency peg or other arrangement, to sharpen the incentives for reforestation.

The idea is that by managing an exchange rate, the government doesn’t have to raise taxes to fund new trees or heavily enforce rules preventing trees being cut down. Instead, it creates inflation. There is still pain for saving the forest. The money that people, companies, and the government itself have buys increasingly less. But it avoids the conflict of vested interests and arguments over trees.

Chen realizes his story was simplistic. DigFin asked about how the currency peg would work – how to ensure the necessary reserves, how to avoid hot capital flows into an appreciating RepCoin that led to things like the collapse of the Thai baht in 1997, etc. Chen’s response was to jump to the paper he wrote that caught Robinson’s attention.

Global carbon rewards

His Global Carbon Reward is not a fixed peg or fixed within a tight band, such as the Hong Kong dollar to the greenback. Instead the central banks would use their reserves to guarantee a floor for the coin, and let market forces dictate the value above that.

To Chen, the question of design is at what price to set the floor. “The floor is determined by the physics of the question,” he says, which would be determined by the amount of carbon dioxide to be removed from the atmosphere.

A vital factor to making this peg work is recognizing that the carbon reward operates in tandem with a full-fledged global campaign to use renewable energy and phase out fossil fuels. Removing carbon from the atmosphere is not a get-out clause to maintain the status quo on the ground.

The carbon reward, issued in the form of a CBDC, has two purposes. One is to reward entities that can prove they have sequestered carbon from the atmosphere. The second is to serve as a baseline – a set of assumptions about energy transition – to encourage entire industries to restructure away from fossil fuels in a short period of time.

Chen notes that the carbon reward for sequestration is not the same thing as a carbon offset. An offset is trading away a country’s quota for emissions to someone else; the amount of pollution doesn’t decrease.

Getting to net zero

Offsetting plays a role as a stepping stone for complete energy transition, but it isn’t enough by itself to enable the world to reach net zero emissions. First, it’s hard to scale. Second, it’s a private initative – the offsets trade on the voluntary carbon market – when the global carbon reward is a government initiative.

The role of a central bank, or ideally a coalition of the major central banks, is to manage the exchange rate of their carbon CBDC versus their fiat currencies. The lower range is to be set against a baseline that targets a certain amount of sequestion (say, 10 gigatons a year).

Baselines could be tailored for specific industries and added up to a global number. For example, the shipping industry is a massive polluter. Today there is no incentive for shipping companies to retrofit their ships.

Nor is there an incentive for technology companies to invest in the required tools (such as hydrogen power, or batteries) because they can’t be sure the shipping companies will buy their products. Ditto for suppliers to the shipping industry.

Carbon QE and MMT

The carbon coin, however, is a way to engineer the incentives. By setting a baseline target, the central banks would make their coin increasingly valuable to companies in the shipping ecosystem to make the necessary changes. This works so long as the CBDC increases in value, and is also fungible and can be used like fiat money.

“Carbon quantitative easing” is a version of modern monetary theory (MMT), which says that big economies that control their own currency can spend, tax and borrow in their fiat currency without constraint. The national debt doesn’t matter, so long as the printed money goes to productive uses that grow the underlying economy. Under MMT, a government needn’t rely on issuing bonds so much if it can also just print money. The system runs into trouble if the money isn’t put to such use, in which case it generates inflation.

The US has arguably followed MMT. In the past two decades it has funded a huge series of wars in Afghanistan and Iraq, engaged in monetary quantitative easing after the 2008 financial crisis, and spent another huge amount on Covid-era stimulus. Today’s inflation and tight labor market are both signs of MMT hitting its limits. These trends, though unwelcome, are nothing like the hyperinflation imagined by MMT’s critics.

Indeed, Chen says inflation is a deliberate outcome of the carbon reward; it is the price the world would have to pay for encouraging the private sector to make rapid and radical changes. But it would avoid the political knife fights from vested interests defending their revenues.

On the other hand, managing pegs and dual-currency systems is difficult and can end in disaster: look at the Thai baht in 1997, the British pound in 1992, and America’s unhappy experiment with bi-metalism in the nineteenth century.

Nor is that the only challenge.

Boiling the ocean

Purveyors of blockchain solutions to digitize trade finance and supply chains will recognize this problem. These initiatives have failed because there weren’t enough incentives to generate global, pan-industry change. And certainly not in the tight timeframe that is required to restructure an industry like shipping.

There’s a phrase in the startup world: “boiling the ocean”, used for overly ambitious projects. It’s a terrible idiom for a discussion about climate change, but is Chen guilty of trying to boil the ocean with his carbon QE?

“We have to boil the ocean to reach the solution,” he insists. “Every aspect of civilization depends on energy, so climate change is an existential problem. Iterative solutions won’t do it. We need a systems change that is cogent, rational, and can quickly scale cooperation.”

Since Robinson came out against crypto, Chen says he is agnostic about whether the reward coin would run on a blockchain. He says it could also exist within the existing real-time gross settlements system used for global payments by correspondent banks using SWIFT messages.

But he gets excited about CBDCs, noting a carbon coin makes for a powerful use case – citing Hong Kong’s Project mBridge, meant to connect multiple economies through CBDCs. “M-Bridge would be ideal,” he says, adding, “Cryptocurrencies are not public-policy instruments.”

Foundation, funding, and the future

Having been operating in small intellectual circles, Chen is now leveraging the attention his idea has received from the success of “The Ministry of the Future”. He has established a non-profit foundation, Global Carbon Reward, to further his ideas and get them in front of central bankers. He is now looking to raise $6.5 million to hire more people, write research papers, and invite central banks and others to run proofs of concept.

Ultimately he wants to get his papers on the agenda at Jackson Hole and other central bank conferences. Chen acknowledges it’s still early days. “We lack the right documents, economic models, and feedback from economists and legal experts. We need to understand the U.N. protocols.”

He’s on a tour, including Hong Kong, to raise funds and awareness. He believes he will be able to insert himself into the conversation in short order. “The world is looking for a solution,” he notes.

For his part, Robinson made the following remarks to an interviewer in June:

“…you begin to slip out of the market system and acknowledge the importance of government as opposed to business, of public as opposed to private, in getting us out of this fix by simply creating money and paying ourselves to do the right thing rather than the wrong thing. Some mechanisms are in that paper by Delton Chen which is now being discussed. I’m really encouraged by the fact that when I wrote The Ministry for the Future just two years ago, this stuff was speculative.

“In the months since then, the World Bank, the European Central Bank, the Federal Reserve of the United States and the Chinese government, which is in control of its central bank, have all declared that there needs to be various versions of carbon quantitative easing. The think tanks are trying to provide the armatures of what kind of laws you would pass. It’s a happening thing because it’s obvious, if we don’t do it, we’re doomed.”

You may like

-

For Zetrix, the future of blockchain is by government

-

Fintech can make voluntary carbon markets sexy again

-

TradFi DLT reality check: what’s working, what’s not

-

Why the RWA revolution will not be televised

-

OKX investing into making Bitcoin a lot more usable

-

Digitizing trade finance in the post-Contour world